OneCard Invite Code

Don’t know how to use it? Read on.

In this article, we will explain everything about the OneCard invite code, its benefits, how to use it, and why you should use it to help you claim the referral benefits.

What is OneCard Invite Code?

Get an assured minimum cashback of ₹250 (up to ₹500) when you sign up for OneCard using my invite code: ANUJNHETV.

You will receive OneCard points as stated below.

Benefits of using OneCard Invite Code

With this code, you’re guaranteed a minimum ₹250 cashback. To enjoy the benefits of the referral program, be sure to use the code during registration.

Here’s how it works:

- Join OneCard using a referral code or link, and you’ll receive ₹250 cashback.

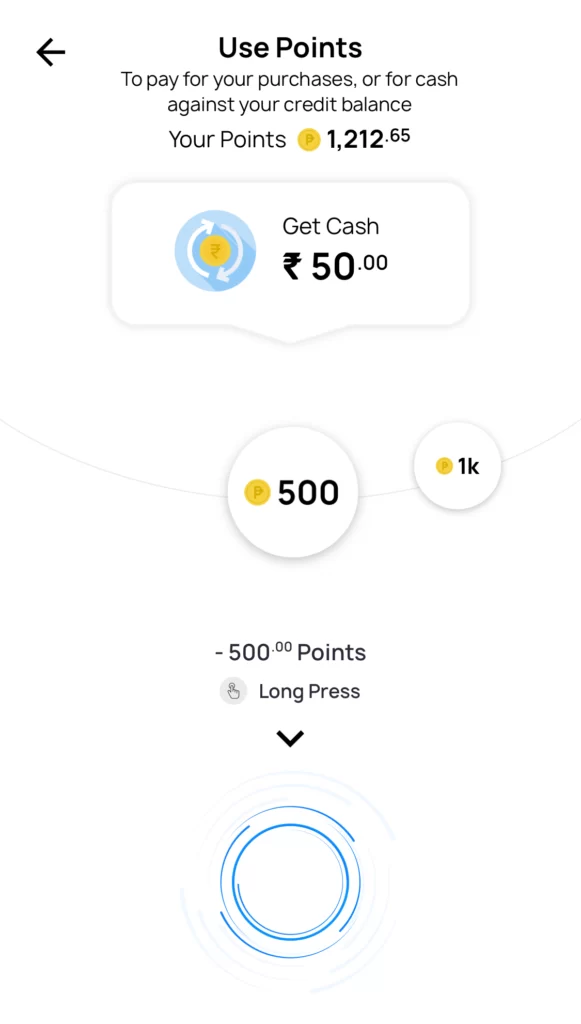

- The cashback will be added in the form of OneCard points, which you can convert into real cash.

- The cashback can be used for online and offline payments, or even to get a free SonyLIV subscription.

How to Use OneCard Invite Code?

- Download OneCard from here, and once it is downloaded, open the app and start the registration

- Complete registration and start applying for a OneCard

- When filling out the details you will see an option “enter invite code(optional)”

- Put the referral code and complete the pending requirements

- Upon receiving the card, you can check your points under the rewards section

Who can use OneCard invite code?

Users who have never used this app before can enter this code during the registration process. While it is optional and not mandatory, using it will reward you with approximately 500 real cash, a generous amount that the app offers to its new users.

A brief Introduction of OneCard

If you’re unfamiliar with OneCard and its benefits, and want to know what other benefits it offers beyond the signup bonus, here’s a brief guide for you.

Why use OneCard?

Your current debit card might not be offering you any cashback on your regular transactions. But OneCard gives you cashback on every transaction, a decent cashback you might be missing out on. This is why you should apply for this card if you are looking for a credit card that offers assured cashback on every transaction.

It gives you cashback in the form of reward points on every single transaction. This means you can earn cashback even on small purchases, adding up over time.

Who can get this card?

OneCard is available to anyone in India above the age of 18. There’s no income proof requirement, and instead, you’ll be asked to create a fixed deposit (FD) of a minimum of ₹2,000. This FD earns you interest annually, providing an additional benefit on top of the cashback rewards.

They offer FD-backed credit cards in partnership with SBM and Federal banks, both of which are RBI-approved banks. You will earn an attractive interest rate of 7.5%* on your FD from these banks.

How to Claim OneCard referral cashback?

You can check your referral bonus by navigating to Rewards on the app. Here you can check you bonus points. The ten points are equivalent to ₹1, which means you will have around 2500-5000 points.

FAQ

1. Where can I find OneCard invite code?

You can find it on tricksszone or you can ask your friend who is already using OneCard app for invite code.

2. What are the benefits of using an invite code?

If you use an invite code during registration, you will get a minimum ₹250 upon approval of OneCard.

3. Can I use multiple invite codes?

No, you can only use one invite code for yourself. However, you can share your code with others to earn bonus rewards.

4. What happens if I don’t use an invite code during registration?

If you don’t use it, you will miss out on potential bonus rewards.